The creation of digital currency relies on advanced systems like blockchain technology, mining, and cryptographic verification. These elements work together to ensure secure and decentralized transactions. At its core, this process involves validating and recording data on a public ledger, which is maintained by a network of computers.

Mining plays a crucial role in this system. Miners use specialized hardware to solve complex mathematical problems, validating transactions and adding them to the blockchain. In return, they are rewarded with new units of crypto. This process not only creates new coins but also secures the network.

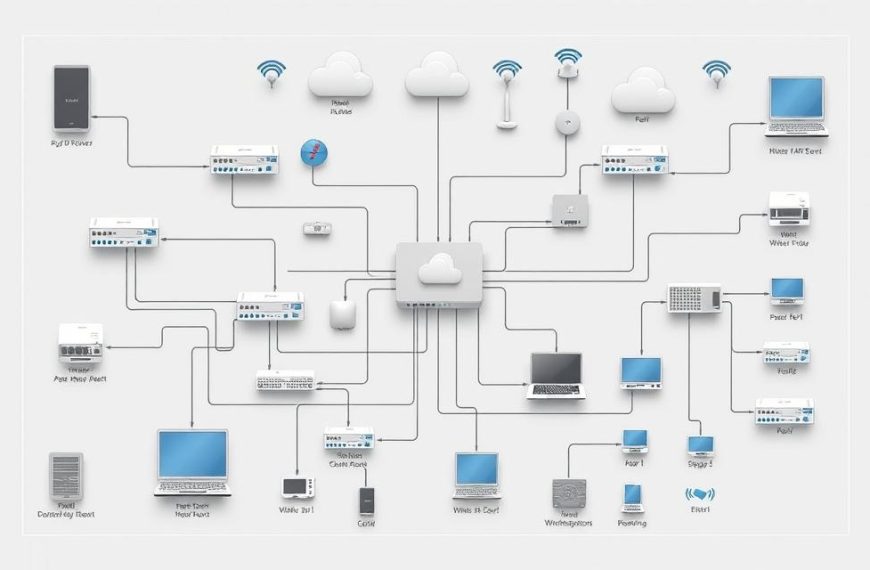

Nodes, or computers in the network, verify and store the blockchain data. This decentralized approach ensures transparency and prevents fraud. Together, these components form the backbone of digital currency, making it a reliable and innovative financial tool.

Introduction to Cryptocurrency

The rise of decentralized payment systems marks a shift in global finance. Unlike traditional money, cryptocurrency operates without central authority or control from banks. This digital innovation allows for secure and transparent transactions, reshaping how we interact with financial systems.

Unlike fiat currency, which is backed by governments and physical assets, digital currency exists purely in electronic form. It lacks FDIC insurance or government guarantees, relying instead on cryptographic technology for security. This decentralized approach ensures that no single entity can manipulate the system.

What Is Cryptocurrency?

Cryptocurrency is a decentralized digital payment system that uses cryptographic techniques to secure transactions. It operates on a peer-to-peer network, eliminating the need for intermediaries like banks. This innovation offers greater transparency and lower transaction costs compared to traditional financial systems.

Brief History of Cryptocurrency

The concept of digital currency emerged in the 1990s, but it wasn’t until 2009 that Bitcoin, the first successful cryptocurrency, was launched. Ethereum followed in 2015, introducing smart contracts and expanding the possibilities of blockchain technology. By 2021, 16% of Americans had used crypto, showcasing its growing adoption.

Market capitalization has surged, with Bitcoin reaching $1.63 trillion and Ethereum $215 billion by 2025. Regulatory milestones, such as the 2024 Supreme Court ruling on crypto securities status, have further shaped its trajectory. This evolution highlights the transformative potential of decentralized finance.

Understanding Blockchain Technology

Blockchain technology serves as the foundation for secure and transparent digital transactions. It is a tamper-proof distributed ledger system that records data across multiple computers. This ensures that no single entity can alter the information, making it highly secure and reliable.

The process of verifying transactions involves cryptographic hashing, block creation, and chain validation. Each transaction is grouped into a block, which is then added to the chain after verification. This decentralized approach eliminates the need for a central authority, ensuring trust and transparency.

One of blockchain’s key roles is preventing double-spending. By using a decentralized verification process, it ensures that each transaction is unique and cannot be duplicated. This is particularly important in digital systems where fraud is a concern.

There are two main types of blockchains: public and private. Public blockchains, like Bitcoin, are open to anyone and rely on consensus mechanisms like Proof of Work (PoW). Private blockchains, often used by enterprises, restrict access and offer more control over the system.

Energy efficiency is another important aspect. Bitcoin’s PoW mechanism requires significant computational power, leading to high energy consumption. In contrast, Ethereum’s transition to Proof of Stake (PoS) aims to reduce energy usage while maintaining security. This evolution highlights the ongoing innovation in blockchain technology.

The Role of Miners in Cryptocurrency Creation

Miners play a pivotal role in maintaining the integrity of decentralized networks. They are responsible for validating transactions and adding them to the blockchain. This process ensures the security and transparency of the entire system.

What Is Cryptocurrency Mining?

Mining is a computational process that secures blockchain networks. Miners solve complex cryptographic puzzles using specialized hardware like ASIC rigs. Once a puzzle is solved, a new block is added to the chain, and the miner is rewarded with digital tokens.

The proof-of-work mechanism is central to this process. It requires miners to perform SHA-256 hashing, a resource-intensive task. This ensures that only legitimate transactions are recorded, preventing fraud and double-spending.

How Miners Verify Transactions

Mining farms are equipped with advanced technology to handle this demanding process. ASIC rigs, cooling systems, and pool mining are commonly used to maximize efficiency. Pool mining allows multiple miners to combine their computational power, increasing their chances of earning rewards.

However, this process comes with significant energy consumption. Bitcoin mining alone consumes twice the energy used for U.S. residential lighting. The Cambridge Bitcoin Electricity Consumption Index highlights this environmental impact.

To address this, emerging alternatives like hydro-cooled farms and flare gas utilization are gaining traction. These innovations aim to reduce the carbon footprint while maintaining network security.

Nodes and Their Importance in Cryptocurrency

Nodes are the backbone of decentralized networks, ensuring security and transparency. These computers interact with the blockchain, storing and verifying data to maintain the integrity of the system. Without nodes, the decentralized network would lack the necessary checks and balances.

What Are Nodes?

Nodes are individual computers that participate in a blockchain network. They store a copy of the ledger and verify transactions to ensure accuracy. There are two main types of nodes: full nodes and lightweight nodes.

- Full nodes store the entire blockchain, requiring significant storage (over 400GB for Bitcoin). They enforce consensus rules and validate block history.

- Lightweight nodes (SPV clients) only download block headers, relying on full nodes for transaction verification.

How Nodes Maintain the Blockchain

Nodes synchronize across the decentralized network, ensuring every participant has the same copy of the chain. This process is crucial for maintaining consensus and preventing fraud. Geographic distribution of nodes enhances censorship resistance, making it harder for bad actors to manipulate the system.

Operating a node requires significant resources, including storage, bandwidth, and uptime. For example, Bitcoin nodes need over 400GB of storage to function effectively. Despite these demands, nodes are incentivized through block rewards and transaction fees, encouraging participation in the network.

| Node Type | Storage Requirement | Function |

|---|---|---|

| Full Node | 400GB+ | Stores entire blockchain, verifies transactions |

| Lightweight Node | Minimal | Relies on full nodes for verification |

Nodes are essential for the security and decentralization of blockchain networks. By distributing data across multiple nodes, the system becomes more resilient to attacks and failures. To learn more about the benefits of operating a node, visit this guide.

Cryptographic Techniques in Cryptocurrency

Cryptographic techniques form the backbone of secure digital transactions in the crypto world. These methods ensure that data remains private, authentic, and tamper-proof. From wallet creation to transaction validation, cryptography is essential for maintaining trust in decentralized systems.

What Are Cryptographic Techniques?

Cryptography is the science of securing information through mathematical algorithms. In the context of crypto, it involves public-key cryptography, hashing, and digital signatures. These tools work together to protect user data and validate transactions.

Public-key cryptography uses a pair of keys: a public key for encryption and a private key for decryption. This ensures that only the intended recipient can access the information. For example, Bitcoin employs the Elliptic Curve Digital Signature Algorithm (ECDSA) with the secp256k1 curve for key generation and verification.

How Cryptography Secures Transactions

Cryptography ensures the security and integrity of transactions in several ways. First, hashing algorithms like SHA-256 convert transaction data into a fixed-length string of characters. This process makes it nearly impossible to alter the data without detection.

Digital signatures add another layer of security. They verify the authenticity of a transaction by proving that it was initiated by the rightful owner of the private key. This prevents fraud and ensures that only valid transactions are added to the blockchain.

Wallet addresses are generated from private keys using cryptographic functions. This process ensures that each address is unique and securely linked to its owner. For instance, Ethereum uses Keccak-256 hashing to derive addresses from public keys.

Despite its strengths, cryptography faces challenges from emerging technologies like quantum computing. Researchers are actively exploring post-quantum cryptography to safeguard crypto systems against future threats.

How Cryptocurrency Is Made: The Creation Process

Developing digital assets involves a blend of innovative tools and advanced systems. This process requires technical expertise and a deep understanding of blockchain frameworks. Whether you’re building a custom blockchain or leveraging existing platforms, each method has its unique steps and requirements.

Step-by-Step Guide to Creating Cryptocurrency

There are four primary methods to create digital tokens:

- Custom Blockchain: Building a new blockchain from scratch offers full control but requires significant resources.

- Hard Fork: Modifying an existing blockchain to create a new version, often used for upgrades or new features.

- Existing Chain Token: Developing tokens on established platforms like Ethereum or Binance Smart Chain.

- Blockchain-as-a-Service (BaaS): Using cloud-based platforms to simplify development and deployment.

For Ethereum-based tokens, Solidity is the go-to programming language. It allows developers to write smart contracts and define token behavior. Other languages like C++ and Python are also widely used in blockchain development.

Tools and Technologies Needed

Creating digital tokens requires a combination of software and frameworks. Here’s a comparison of popular blockchain platforms:

| Platform | Key Features | Token Standards |

|---|---|---|

| Ethereum | Smart contracts, decentralized apps | ERC-20, ERC-721 |

| Binance Smart Chain | Low fees, high speed | BEP-20 |

| Cardano | Sustainability, scalability | Native tokens |

Development tools like Truffle Suite, Remix IDE, and Ganache simplify coding, testing, and deployment. These tools provide a seamless workflow for developers, from writing smart contracts to launching on the mainnet.

Before launching, tokens are deployed on a testnet to ensure functionality and security. Once tested, they are moved to the mainnet for public use. This step-by-step approach ensures a smooth and secure launch.

Proof of Work vs. Proof of Stake

Proof of Work and Proof of Stake represent two distinct approaches to securing blockchain networks. These consensus mechanisms ensure the validity of transactions while addressing critical issues like energy consumption and network security. Understanding their differences is essential for anyone exploring decentralized systems.

Understanding Proof of Work

Proof of Work (PoW) relies on miners solving complex mathematical puzzles to validate transactions. This process requires significant computational power, often leading to high energy consumption. Bitcoin, for example, uses PoW and consumes approximately 707 kWh per transaction.

PoW’s security model is based on the difficulty of these puzzles, making it resistant to attacks. However, the reliance on specialized hardware like ASICs has led to centralization concerns. Miners with more resources dominate the network, potentially undermining decentralization.

Understanding Proof of Stake

Proof of Stake (PoS) replaces mining with staking, where validators lock up a portion of their tokens as collateral. This process is far more energy-efficient, as seen with Ethereum’s transition to PoS, reducing its energy consumption by 99.95%.

Cardano’s Ouroboros PoS protocol is another example, offering scalability and sustainability. Staking mechanics often include minimum token requirements and slashing conditions to penalize malicious behavior. This approach encourages participation while maintaining network security.

| Consensus Mechanism | Energy Consumption | Security Model |

|---|---|---|

| Proof of Work | 707 kWh/tx (Bitcoin) | High computational difficulty |

| Proof of Stake | 0.0006 kWh/tx (Solana) | Staking and slashing |

Hybrid models like Decred’s combination of PoW and PoS aim to balance security and efficiency. By leveraging the strengths of both mechanisms, they offer a robust solution for decentralized networks.

“The shift from PoW to PoS marks a significant step toward sustainable blockchain technology.”

As the industry evolves, the choice between PoW and PoS will continue to shape the future of decentralized systems. Each mechanism has its trade-offs, but the focus remains on improving efficiency and security.

Creating Your Own Cryptocurrency

The journey to creating a digital token requires technical expertise and legal awareness. Whether you’re building a custom blockchain or leveraging existing platforms, understanding the process is crucial. This section explores the options available and the legal considerations you must address.

Options for Creating a Cryptocurrency

There are several paths to developing your own crypto asset. Each method has its advantages and challenges, depending on your goals and resources.

- Forking an Existing Blockchain: This involves modifying an existing blockchain to create a new version. It’s a quicker approach but requires technical skills.

- Smart Contract Tokens: Platforms like Ethereum allow you to create tokens using smart contracts. This method is cost-effective and widely used.

- Custom Blockchain: Building a blockchain from scratch offers full control but demands significant investment and expertise.

- Blockchain-as-a-Service (BaaS): Providers like AWS Blockchain Templates simplify development, making it accessible for businesses.

Legal Considerations

Navigating the legal landscape is essential when creating a crypto asset. Regulations vary by jurisdiction, and compliance is critical to avoid penalties.

The SEC v. Ripple case highlights the importance of understanding security classifications. The Howey Test is often used to determine if a token qualifies as a security. If it does, SEC registration is mandatory.

Additionally, implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols is necessary for exchange listings. Jurisdictional variations, such as those between the U.S., EU, and Singapore, further complicate the process.

“Compliance is not just a legal requirement; it’s a cornerstone of trust in the crypto ecosystem.”

By carefully evaluating your development path and adhering to regulations, you can successfully launch a digital token while minimizing risks.

Challenges in Cryptocurrency Creation

The path to creating digital assets is fraught with obstacles that test both technical and regulatory boundaries. From scalability issues to evolving legal frameworks, these challenges shape the future of the market. Understanding these hurdles is crucial for anyone venturing into this space.

Technical Challenges

One of the most pressing issues is the scalability trilemma. Balancing security, decentralization, and speed remains a significant challenge. For instance, Bitcoin’s focus on security and decentralization comes at the cost of slower transaction speeds.

Smart contract vulnerabilities also pose a risk. Flaws in code can lead to exploits, as seen in the DAO hack. Regular audits are essential to identify and fix these issues before deployment. Platforms like CertiK and OpenZeppelin provide tools for thorough code reviews.

Additionally, the technology behind blockchain is still evolving. Energy consumption in mining and the need for more efficient consensus mechanisms are ongoing concerns. Innovations like Ethereum’s transition to Proof of Stake aim to address these problems.

Regulatory Challenges

Regulatory uncertainty is another major hurdle. The SEC’s enforcement actions, such as the case against Ripple, highlight the complexities of compliance. The Howey Test is often used to determine if a token qualifies as a security, requiring registration with the SEC.

Cross-border compliance adds another layer of complexity. Different jurisdictions have varying rules, making it challenging to operate globally. For example, the EU’s MiCA regulations differ significantly from U.S. guidelines.

Recent stablecoin regulations further complicate the landscape. The debate between USDC and USDT underscores the need for clear legal frameworks. These developments impact how projects are launched and managed.

| Challenge | Example | Impact |

|---|---|---|

| Scalability Trilemma | Bitcoin’s slow transaction speeds | Limits mass adoption |

| Smart Contract Vulnerabilities | DAO hack | Financial losses, reputational damage |

| Regulatory Uncertainty | SEC v. Ripple case | Legal risks, compliance costs |

Despite these challenges, the market continues to evolve. By addressing technical and regulatory hurdles, the industry can unlock its full potential. As the landscape matures, solutions to these problems will pave the way for broader adoption.

Environmental Impact of Cryptocurrency Creation

The environmental footprint of digital asset creation has become a critical topic in recent years. As the demand for these assets grows, so does the concern over their ecological impact. From energy consumption to sustainable practices, the industry is under pressure to innovate and reduce its carbon footprint.

Energy Consumption in Mining

Bitcoin mining alone consumes approximately 127 terawatt-hours of electricity annually. This staggering figure highlights the energy consumption associated with the mining process. Traditional banking systems, in comparison, have a significantly lower carbon footprint per transaction.

To address this, renewable energy initiatives are gaining traction. For example, Texas wind farms are now powering large-scale mining operations. These efforts aim to reduce reliance on fossil fuels and promote greener practices.

Sustainable Practices in Cryptocurrency

The shift toward sustainable technology is reshaping the industry. Ethereum’s transition to Proof of Stake (PoS) reduced its energy use by 99.95%. This process eliminates the need for resource-intensive mining, making it a more eco-friendly alternative.

Green blockchain projects like Chia, which uses proof-of-space, are also emerging. These innovations prioritize energy efficiency while maintaining network security. Additionally, initiatives like the Crypto Climate Accord encourage carbon offset programs to neutralize emissions.

| Consensus Mechanism | Energy Consumption | Environmental Impact |

|---|---|---|

| Proof of Work (Bitcoin) | 127 TWh/year | High carbon footprint |

| Proof of Stake (Ethereum) | 0.0026 TWh/year | Low carbon footprint |

By adopting these sustainable practices, the blockchain industry can mitigate its environmental impact. As the technology evolves, the focus remains on balancing innovation with ecological responsibility.

Future Trends in Cryptocurrency Creation

The evolution of digital finance continues to shape the future of global transactions. As the market matures, new technologies and innovations are emerging to address scalability, security, and efficiency. These advancements are paving the way for a more robust and inclusive financial ecosystem.

Emerging Technologies

Layer-2 solutions like the Lightning Network and Optimistic Rollups are gaining traction. These technologies enhance transaction speeds and reduce costs, making blockchain networks more accessible to users. For example, the Lightning Network enables instant micropayments, while Optimistic Rollups improve scalability by processing transactions off-chain.

Zero-knowledge proofs, such as zk-SNARKs, are another breakthrough. They allow parties to verify transactions without revealing sensitive data. This technology enhances privacy and security, addressing one of the key concerns in the crypto space.

Quantum-resistant algorithms are also on the horizon. With quantum computing expected to become mainstream by 2030, these algorithms will safeguard blockchain networks against potential threats. This proactive approach ensures the long-term viability of digital assets.

Predictions for the Future

Institutional adoption is set to accelerate, with major players like BlackRock entering the market. The introduction of crypto ETFs will attract more investors, driving liquidity and stability. This trend signals a shift toward mainstream acceptance of digital assets.

Interoperability protocols like Polkadot and Cosmos are addressing fragmentation in the blockchain ecosystem. These platforms enable seamless communication between different networks, fostering collaboration and innovation. For instance, Polkadot’s parachain architecture allows independent blockchains to share data securely.

Regulatory standardization efforts are also underway. Governments worldwide are working to establish clear guidelines for the crypto industry. Over 130 countries are developing Central Bank Digital Currencies (CBDCs), signaling a move toward regulated digital finance.

“The future of digital finance lies in the seamless integration of technology, regulation, and innovation.”

As these trends unfold, the blockchain industry will continue to evolve, offering new opportunities and challenges. By staying ahead of these developments, stakeholders can navigate the changing landscape with confidence.

Conclusion

The evolution of blockchain technology has revolutionized the way digital assets are created and managed. From consensus mechanisms like Proof of Stake to advanced cryptographic techniques, these innovations ensure security and transparency in the process.

Balancing technical advancements with regulatory compliance remains a key focus. As the industry grows, the professionalization of crypto development is becoming more evident. This shift ensures that projects meet both technical and legal standards.

Environmental progress is also a priority. The adoption of energy-efficient methods, such as Proof of Stake, highlights the industry’s commitment to sustainability. These changes reflect a broader effort to reduce the ecological impact of digital finance.

For those interested in this field, continuous learning is essential. Programs like Duke’s DeFi course offer valuable insights into the evolving world of technology and investment. Staying informed is crucial for navigating this dynamic landscape.