Modern businesses rely on accounting information systems to streamline financial workflows and enhance decision-making. These systems combine technology, data, and management practices to create a seamless framework for handling complex transactions.

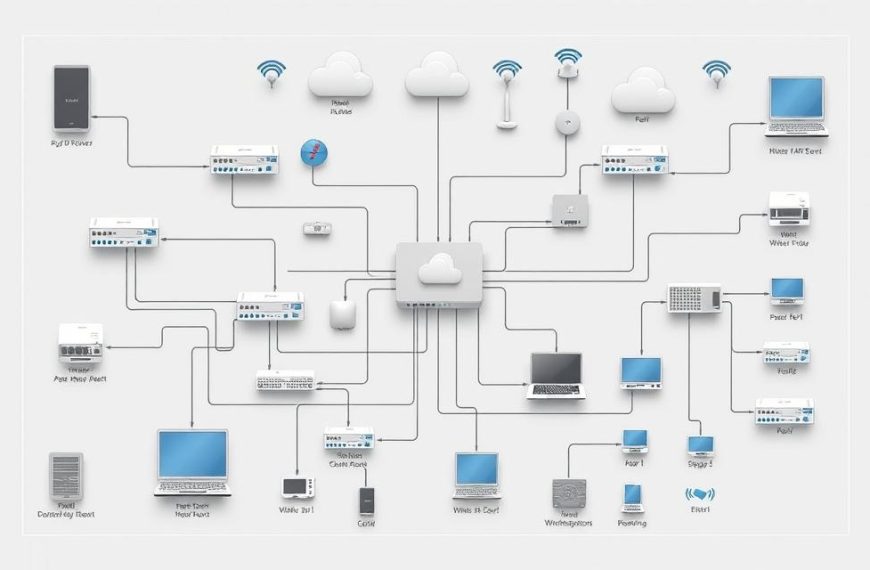

With the rise of automation and cloud-based platforms, AIS eliminates manual errors and accelerates processing times. Centralized financial data ensures accuracy and accessibility, empowering businesses to make informed decisions quickly.

Cybersecurity remains a critical focus, as human errors account for 80% of breaches. Advanced solutions like biometric access controls help safeguard sensitive information, ensuring business continuity and trust.

Introduction to Accounting Information Systems (AIS)

The backbone of modern financial operations lies in accounting information systems. These systems integrate technology, data, and processes to streamline financial tasks. They ensure accuracy, transparency, and efficiency in handling complex transactions.

What is an Accounting Information System?

An accounting information system is a framework designed to collect, store, and process financial data. It combines hardware, software, and procedures to manage financial operations. From tracking expenses to generating reports, these systems are essential for growth and decision-making.

The Evolution of AIS in Modern Business

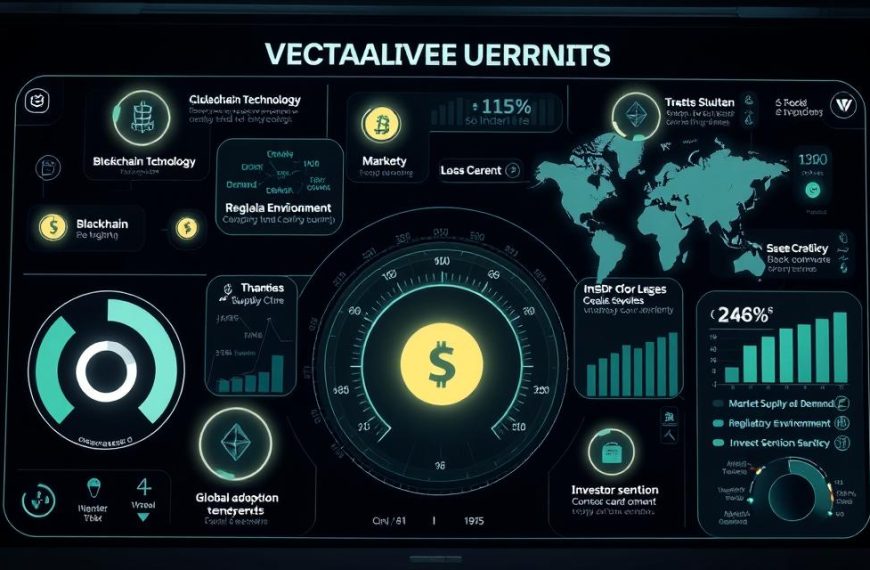

Accounting information systems have come a long way. Early systems relied on manual ledgers and spreadsheets. Today, they leverage AI-driven analytics and real-time data processing. Blockchain technology has further enhanced audit integrity and financial transparency.

Cloud-based platforms enable remote access to financial data. However, they require advanced cybersecurity measures to protect sensitive information. According to Bilson Kim’s 2022 research, automation in AIS significantly boosts efficiency and reduces errors.

| Stage | Technology | Impact |

|---|---|---|

| Manual Ledgers | Paper-based | Time-consuming, prone to errors |

| Spreadsheets | Excel, Lotus 1-2-3 | Improved accuracy, limited scalability |

| AI-Driven Analytics | Machine Learning | Real-time insights, enhanced decision-making |

For a deeper dive into accounting information systems, explore how they’ve evolved to meet modern business needs.

Why Is AIS Important to Business?

Efficient financial management drives business success in today’s competitive landscape. Accounting information systems (AIS) play a pivotal role in enhancing operations and reducing risks. By automating workflows and enforcing strict controls, these systems ensure accuracy and reliability in financial processes.

Enhancing Financial Data Management

AIS improves data handling by centralizing financial information. Real-time anomaly alerts detect irregularities, preventing fraud before it escalates. Multi-tiered approval processes ensure only authorized personnel can access sensitive data.

Cloud-based backups mitigate data loss risks. According to Kim’s 2022 study, encryption solutions further enhance security, safeguarding against unauthorized access. Automated audit trails ensure compliance with GDPR and SOX regulations.

Reducing Operational Risks

Human errors account for 80% of data breaches. AIS minimizes these risks through automated workflows and anomaly detection. By streamlining processes, businesses achieve higher efficiency and operational excellence.

Advanced security measures, such as biometric access controls, protect sensitive information. These features ensure business continuity and build trust with stakeholders.

| Feature | Benefit |

|---|---|

| Real-Time Alerts | Prevents fraud and detects anomalies |

| Multi-Tiered Approvals | Ensures secure data sharing |

| Cloud Backups | Mitigates data loss risks |

| Automated Audits | Ensures regulatory compliance |

The Role of AIS in Strategic Decision-Making

Strategic decision-making relies heavily on accurate financial insights. Accounting information systems (AIS) provide the foundation for informed choices, enabling businesses to stay competitive in dynamic markets. By centralizing data and automating processes, these systems empower leaders to focus on growth and innovation.

Providing Real-Time Financial Insights

AIS delivers real-time access to financial information, ensuring leaders have the latest data at their fingertips. This capability is crucial for identifying trends, forecasting outcomes, and responding to market changes. For example, CFOs rely on AIS for mergers and acquisitions due diligence, ensuring scalability and risk mitigation.

Integration with CRM and ERP systems enhances holistic planning. This seamless connection improves cross-departmental collaboration, streamlining operations from inventory management to customer billing efficiency.

Supporting Data-Driven Business Strategies

Data-driven strategies are the backbone of modern business success. AIS enables competitive benchmarking by analyzing performance metrics and identifying areas for improvement. According to Kim’s research, organizations using AIS achieve higher operational efficiency and better decision-making outcomes.

Key benefits of AIS in strategy development include:

- Enhanced inventory management through real-time tracking.

- Improved customer billing accuracy and speed.

- Streamlined administration processes for better resource allocation.

By leveraging AIS, businesses can transform financial data into actionable insights, driving long-term success and innovation.

Technological Advancements in Accounting Information Systems

Technological innovations are reshaping accounting information systems, offering new levels of efficiency and security. From AI-driven automation to cloud-based platforms, these advancements are transforming how organizations manage financial data.

AI and Automation in AIS

Artificial intelligence is revolutionizing accounting systems by automating repetitive tasks and reducing errors. AI-powered tools analyze vast amounts of data, providing actionable insights for better decision-making. For example, predictive analytics helps forecast cash flow trends, enabling proactive financial planning.

Automation also enhances compliance by generating audit trails in real-time. This ensures adherence to regulations like GDPR and SOX, minimizing risks associated with manual processes.

Cloud-Based AIS and Data Security

Cloud-based accounting systems offer scalability, remote access, and automatic updates. These features make them ideal for modern organizations with distributed teams. However, they also introduce risks like phishing attacks and unauthorized access.

To mitigate these threats, multi-factor authentication and biometric access controls are essential. Accounting Seed warns against relying solely on passwords, emphasizing the need for advanced security measures. Hybrid cloud models provide an additional layer of protection by storing sensitive financial data on-premises while leveraging cloud services for scalability.

Blockchain technology further enhances security by creating tamper-proof records. Kim’s 2022 case study highlights effective ransomware recovery protocols, ensuring business continuity even in the face of cyber threats.

- Scalability: Cloud-based AIS adapts to growing business needs without requiring significant infrastructure changes.

- Remote Access: Teams can access financial data from anywhere, improving collaboration and efficiency.

- Automatic Updates: Cloud platforms ensure systems are always up-to-date with the latest features and security patches.

Conclusion

Accounting information systems have become essential tools for modern enterprises. They automate workflows, enhance decision accuracy, and drive efficiency across financial operations. Adopting AI and cloud-based solutions ensures competitive parity in today’s fast-paced business environment.

Proactive cybersecurity measures, such as encryption and staff training, are critical to mitigating risk. These steps safeguard sensitive data and build trust with stakeholders. For those seeking expertise, SOU’s MBA program offers a pathway to mastering technology and management in AIS.

Businesses should audit their current AIS capabilities to identify areas for improvement. Leveraging these systems effectively fosters growth and ensures long-term success in an evolving marketplace.

FAQ

What is an Accounting Information System (AIS)?

An Accounting Information System (AIS) is a software solution designed to collect, process, and manage financial data. It integrates technology, processes, and people to streamline accounting tasks and improve reporting accuracy.

How does AIS enhance financial data management?

AIS organizes financial information efficiently, ensuring accurate record-keeping and easy access to data. It automates tasks like transaction processing, reducing errors and saving time for businesses.

What role does AIS play in reducing operational risks?

AIS minimizes risks by improving data security and preventing unauthorized access. It also ensures compliance with tax regulations and financial reporting standards, reducing the chance of penalties.

How does AIS support strategic decision-making?

AIS provides real-time financial insights, enabling businesses to make informed decisions. It helps analyze trends, forecast growth, and allocate resources effectively for better outcomes.

What are the benefits of cloud-based AIS?

Cloud-based AIS offers flexibility, scalability, and enhanced data security. It allows remote access to financial information, ensuring seamless operations and collaboration across teams.

How does AI and automation impact AIS?

AI and automation in AIS improve efficiency by handling repetitive tasks like data entry and reconciliation. They also enhance accuracy and provide advanced analytics for better financial management.

Can small businesses benefit from AIS?

Yes, AIS is scalable and adaptable, making it suitable for small businesses. It helps streamline processes, improve cash flow management, and support growth without requiring extensive resources.